The FleetPro Blog: Tax Relief For Company Cars And Vans

A money back offer from HM Government ....

Tax Relief For Company Cars And Vans

Tax Relief For Company Cars And Vans

1 July 2020

The taxman giveth and the taxman taketh away ....

We explain the complex and sometimes contradictory rules for company car and van tax relief.

For these posts we've assumed that your business isn't a leasing or finance company (where special rules apply).

Company Cars

If your company buys or leases cars for use in its business then tax relief is normally available for the cost of buying/leasing/running the cars.

The way tax relief is given depends on how the cars are acquired.

There are differences in tax relief for the main aquisition methods and you can read more about each approach by clicking on the links below (we'll keep your place here whilst you follow the links):

Company Vans

Once again there are differences in tax relief depending on how the van is funded - click on the links below for more details:

Running Costs

Generally the day-to-day running costs for company cars and vans are eligible for tax relief, subject to the normal rules for business tax deductions.

Costs allowed each year as a tax deduction include servicing and maintenance, insurance, vehicle excise duty (the 'tax disc'), fuel, road tolls and repairs.

VAT

The rules for recovering Value Added Tax on company cars and vans are almost as complex as those for tax relief and we've dedicated a special post to this topic which you can read by clicking here.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

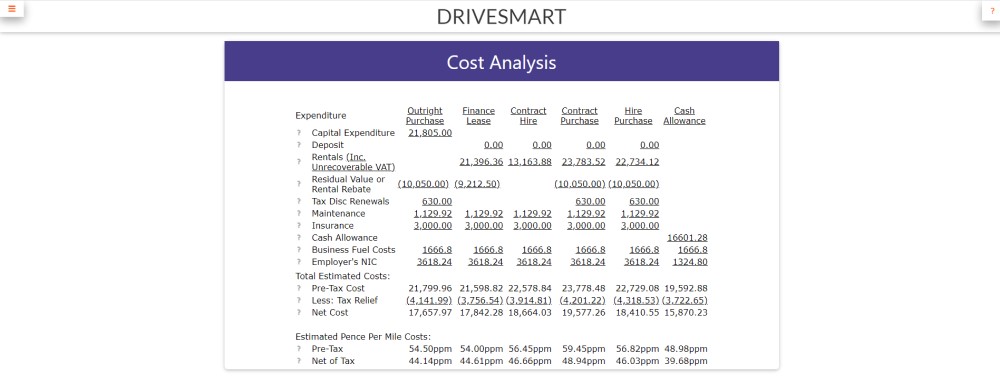

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

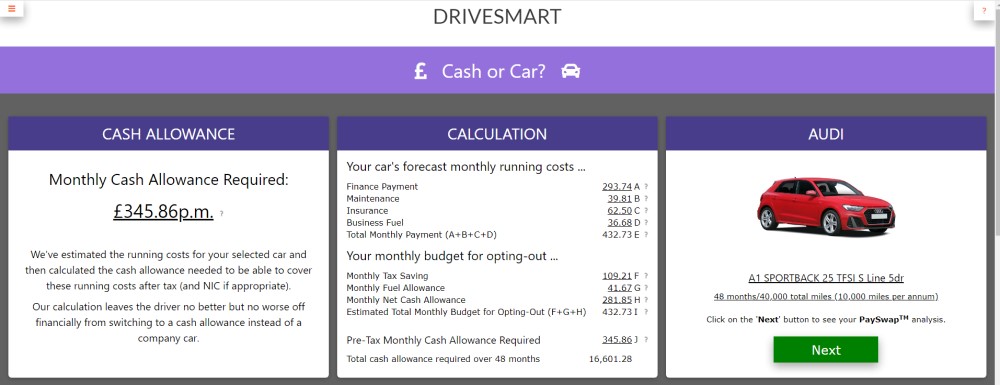

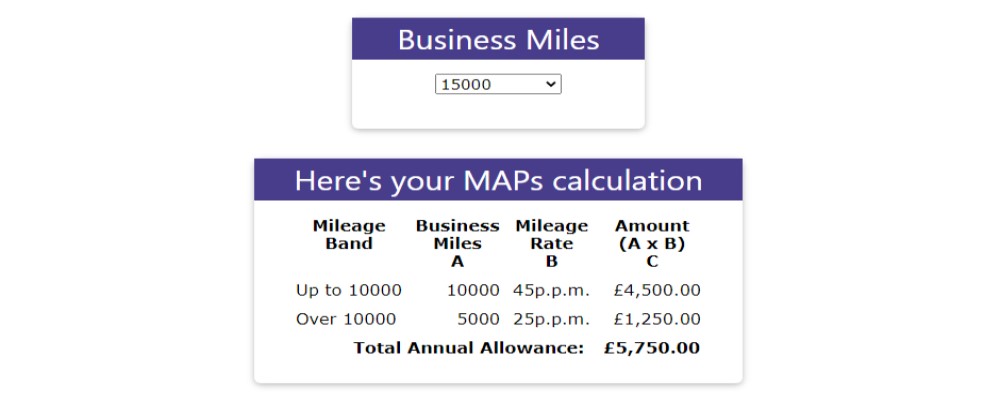

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.