The FleetPro Blog: Capital Allowances For Vans

We explain the complex rules ....

Capital Allowances For Vans

Capital Allowances For Vans

Tax relief for depreciation on vans is given through a system called Capital Allowances

How Do Capital Allowances Work?

Capital Allowances work by giving tax relief for the depreciation in value of a business van each tax year.

Depreciation in this context is the drop in value of the van compared to the original purchase price.

This includes the basic cost of the van plus delivery charges and the initial registration fee, but excluding the annual vehicle excise duty or tax disc (which is an annual running cost deductible against business taxes in the ordinary way).

A proportion of the depreciation is allowed against business taxes each year, irrespective of the actual depreciation of the van.

The current percentage rate of depreciation allowed for vans as a deduction against business taxes is 18%.

For example:

A van is purchased for £20,000

The existing capital allowances pool is already at £100,000

The value of the pool becomes £120,000

Capital allowances are given at 18% on the total pool, i.e. £21,600

The pool value carried forward to the next year is £120,000 - £21,600 = £98,400

When the van is sold the sale proceeds are deducted from the value of the pool.

If the sales proceeds are less than the purchase price less capital allowances already given then the difference will continue to be written down in the pool.

As a result, capital allowances may continue to be given on the difference between the purchase and sale prices for many years after the vehicle has been sold.

Zero Emissions Vans

Until 31 March 2021, vans emitting 0g/km of CO2 are eligible for 100% first year allowances, provided that the government's Plug-In Van Grant has not also been claimed.

What this means is that the full purchase price of Zero Emissions vans can be written off for tax purposes in the year of purchase, assuming that there are sufficient profits available to use up the purchase price.

Annual Investment Allowance (AIA)

Businesses are able to claim the full purchase cost of vans that qualify for the annual investment allowance against profits, currently up to a limit of £200,000p.a.

Businesses can then claim capital allowances on the excess if the total spent on plant and machinery in a year exceeds the annual limit.

Effects of Capital Allowances

Because company vans typically depreciate at a rate faster than the 18% capital allowances rate, the practical effect of capital allowances is to defer busines tax relief on depreciation for company vans unless they qualify for the accellerated Zero Emissions allowance or AIA.

This means that, for vans bought outright, tax relief on the total cost of depreciation may not be given until years after the the vehicle has been sold.

Self-employed

For the self-employed where the vehicle is used partly for non-business purposes, tax relief is apportioned according to the ratio of annual business miles to total annual miles.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

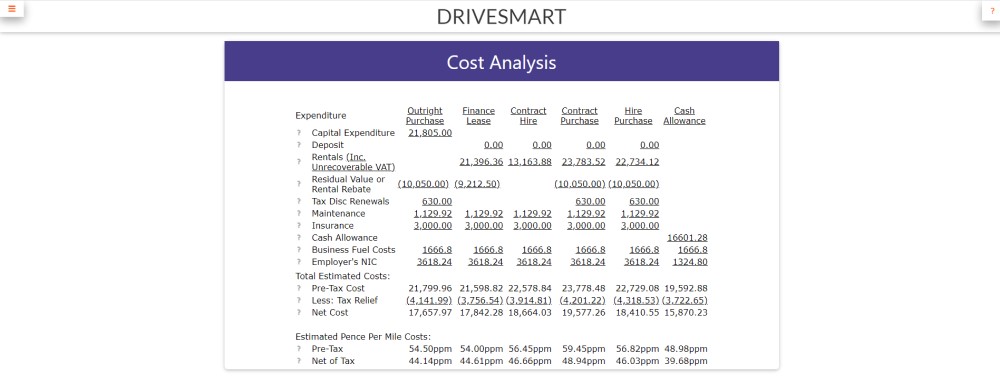

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

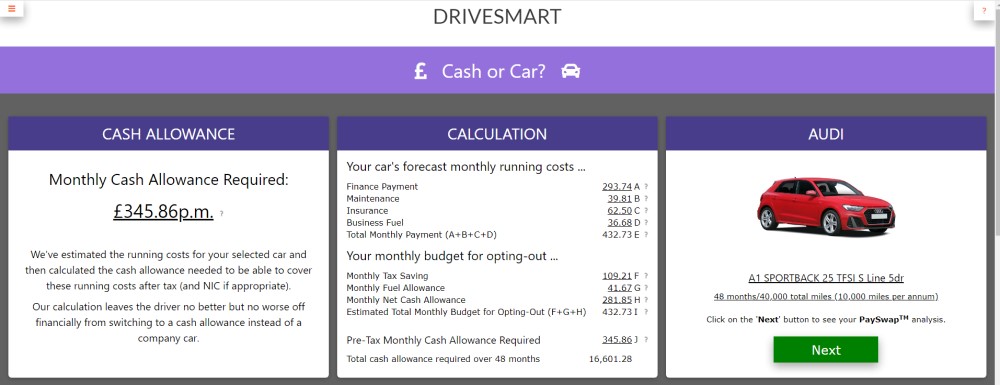

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

drivesmart.co.uk

Why not visit our drivesmart.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.