The FleetPro Blog: Electric Company Car Tax

Make the most of special tax reductions for electric company cars

Electric Company Car Tax

7 September 2020

We explain company car tax for electric cars

Get Yourself On The Zero List!

From 6 April 2020, if you drive an electric company car you won't have to pay a single penny in tax on the benefit for the entire tax year 2020-21.

There are some requirements, but basically the rule is that fully electric cars get taxed at 0%.

And for continuity and clarity the Government has already settled the taxable benefit of electric company cars for 2021-22 and 2022-23:

- 2021-22: 1% of taxable list price*

- 2022-23: 2% of taxable list price*

For a full run-down of how the UK company car tax system works follow this link, but for just electric cars let's look at the specifics of how you could qualify for a 0% rate of tax on an electric company car up to 5 April 2021.

Who's On The Zero List?

Let's start by explaining what exactly the Zero List is about.

To get onto The Zero List, a company car needs to be either:

- registered before 6 April 2020 and not emit any CO2 (for example, electric or hydrogen powered cars); or

- registered from 6 April 2020 and either;

- not emit any CO2; or

- emit less than 50GP/Km of CO2 and travel at least 130 miles on electric power only (e.g. hybrids).

Not too long ago that would have meant a fairly restricted choice of cars, but now manufacturers are all working towards expanding their ranges of electric and hybrid vehicles.

As a result, there are now over 90 models on The Zero List, including a wide choice of body styles and equipment levels, though right now they are all electric-power only (there are two hydrogen fuel cars, but these use the hydrogen to create electricity).

At the moment we don't know of any hybrids which can meet the 130 mile requirement for travel only on electric power, but all is not lost.

Tax Reductions For Hybrids Too!

In addition to The Zero List for all-electric company cars, there's a sliding scale of lower taxable benefits for hybrid cars.

The level of taxation depends on when the car was registered are registered and how many miles it can manage on electric-only power.

Basically, the higher the number of miles a hybrid can travel just on electric power, the lower the taxable benefit.

Here's the scale of taxable percentage of list price for hybrid cars from 2020-21 tax year:

CARS REGISTERED

|

|||||

CO2

|

ELECTRIC

|

PERCENTAGE OF LIST PRICE |

|||

| 2020-21 | 2021-22 | 2022-23 | |||

| 0 | N/A | 0 | 1 | 2 | |

| 1-50 | 130 or more | 2 | 2 | 2 | |

| 1-50 | 70-129 | 5 | 5 | 5 | |

| 1-50 | 40-69 | 8 | 8 | 8 | |

| 1-50 | 30-39 | 12 | 12 | 12 | |

| 1-50 | Below 30 | 14 | 14 | 14 | |

CARS REGISTERED

|

||||

CO2

|

ELECTRIC

|

PERCENTAGE OF LIST PRICE |

||

| 2020-21 | 2021-22 | 2022-23 | ||

| 0 | N/A | 0 | 1 | 2 |

| 1-50 | 130 or more | 0 | 1 | 2 |

| 1-50 | 70-129 | 3 | 4 | 5 |

| 1-50 | 40-69 | 6 | 7 | 8 |

| 1-50 | 30-39 | 10 | 11 | 12 |

| 1-50 | Below 30 | 12 | 13 | 14 |

From April 2020 some of the Company Car Benefit reductions for hybrids are substantial.

To put the above numbers into perspective, in 2019-20 the taxable percentage of list price for all cars which met the April 2020 requirements was 16%.

This means that hybrids which do meet the electric-only range targets during the next 3 tax years could qualify for a reduction of up to 16% in the Company Car Benefit compared to 2019-20 tax year.

Not Just Tax Savings

Because of the way that employer's National Insurance Contributions (NICs) on company cars are calculated, the new rules mean that employers could also save NICs from employees switching to electric cars or hybrids.

Employer's NICs are based on the same value as the Company Car Benefit for the employee, so if an employee gets a car on The Zero List (or a hybrid with a high electric-only range) which is registered before 6 April 2023 then his /her employer will save on NICs as well.

The Losers

Drivers who take a cash allowance instead of a company car could find they are losers from the new taxable benefit rates.

If their employer starts to benchmark the cash allowance against cars which qualify for the new super low taxable benefits, this could cut the tax savings the employees get from taking a cash allowance.

Employees should always take into account the tax savings from opting out of a company car when calculating the true spending power of their cash allowance.

If the tax liability on a benchmark company car drops, so does the spending power of the employee's cash allowance.

If that all sounds horribly complicated then try our 'cash or car' calculator to see the effect on you.

Meanwhile ....

Who's On The Zero List?

The Zero List is quite short, but the good news is that the range of body styles and equipment levels is diverse, so hopefully there's something for you.

Take a look at The Zero List here ...

What About Hybrids?

If you can't see what you want on The Zero List, check out our list of hybrid cars that qualify for a reduction in company car tax from 2020-21 - it's still possible to make substantial savings in company car tax by swapping to a hybrid company car.

Keep Coming Back

We'll be updating The Zero List and The Hybrid List as new models are released, so keep checking back here to see the latest qualifiers.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

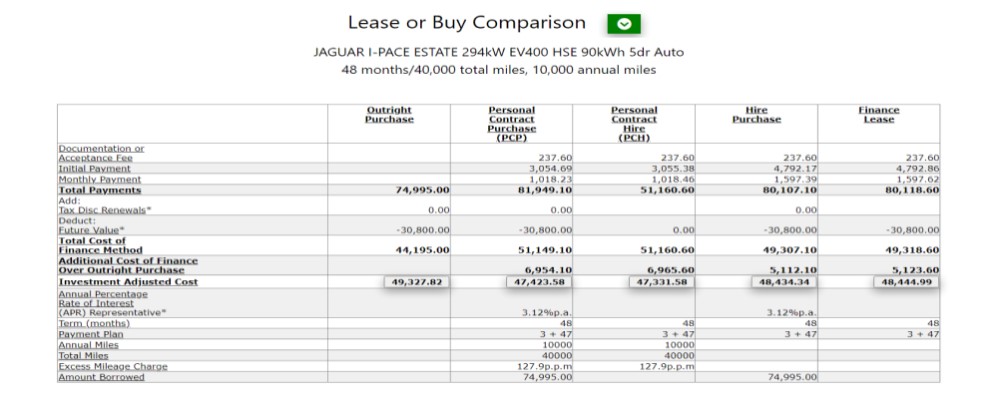

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

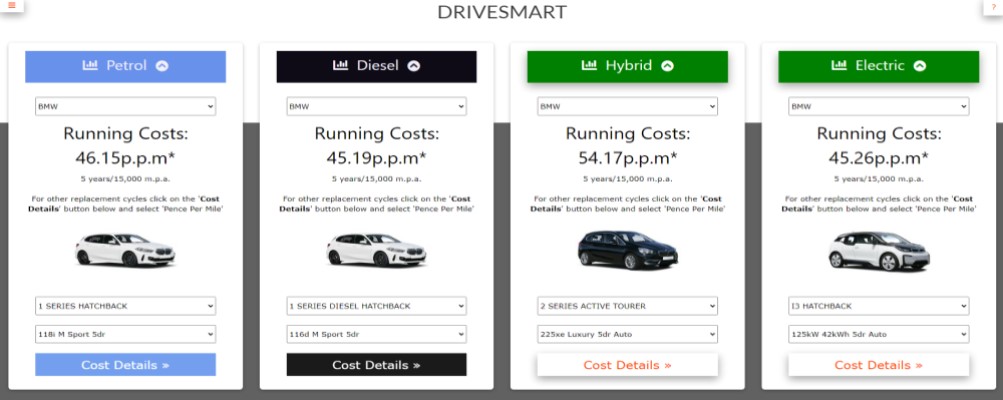

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

drivesmart.co.uk

Why not visit our drivesmart.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.