The FleetPro Blog: Compare ICE And Electric Car Costs

We explain the differences in running costs and why it matters

ICE And Electric Car Cost Comparisons

27 August 2020

How much does an electric car cost to run compared to petrol or diesel?

We explain the cost differences between ICE and electric cars

Electric vehicles are relatively new and their price performance in the used car market is yet to stabilise, so depreciation is potentially a major risk for early adopters.

Having said that, current second-hand values for electric cars are reasonably strong compared to ICE powered vehicles, but this may not last as manufacturers overcome a combination of shortages of battery supplies and high demand for the product.

But on the other hand, improvements in battery technology (longer range/faster recharge times), plus other factors such as autonomous driving capabilities, may combine to make electric vehicles bought now less desirable than newer models launched in the next few years.

Against this complex background, how do you calculate the cost of buying and running an electric car compared to its ICE powered equivalents?

What's In The Running Costs?

For an ICE powered car the costs are fairly straightforward and well established. They comprise:

- Depreciation - the difference between the price you pay for the car and the price you sell at

- Maintenance and servicing

- Insurance

- Vehicle Excise Duty (the 'tax disc')

- Fuel

- Finance charges if you take out a loan to fund the car

With an elecric car the breakdown is the same, but in different proportions.

Do the maths on an electric car and you'll probably see:

- lower fuel and maintenance costs because electricity is typically cheaper per mile driven than petrol or diesel

- higher insurance costs, as electric cars have a more sophisticated body structure which is more expensive to repair

- a different profile to depreciation costs because of a shortage of EV supply, creating a healthy second-hand market.

When supply catches up with demand it's possible that electric car depreciation will begin to stabilise into a pattern more akin to that of ICE powered cars, but ICE cars may in themselves suffer higher depreciation when:

- the popularity of EVs grows

- we move closer to the UK Government's proposed ban on the sale of ICE cars

- air quality taxes (congestion charging, etc) increase to make up for lost revenue from petrol and diesel

- more low emissions zones are introduced around the UK

One of these factors could be key to electric car take up in the UK. The Government has to somehow make up for the revenue which will undoubtably be lost through declining ICE fuel sales.

Taxation already accounts for around 60% of the price of a litre of fuel and generates over £28billion in income each year for the Government (though COVID-19 will have affected this revenue in 2020)

It's still likely, though, that some alternative form of tax will need to be paid by electric car drivers in order to make up for the loss of revenue from ICE fuels and, as yet, how this will work has not been made public by the Government. It could take the form of:

- higher electricity bills for everyone not recharging through low/zero emission methods such as solar power

- higher annual tax disc fees for electric cars (electric cars currently pay no tax disc)

- higher initial registration charges for electric cars when new

So How Do You Calculate Costs?

Getting back to car and van running costs in general, there are specialists with expertise in forecasting car running costs.

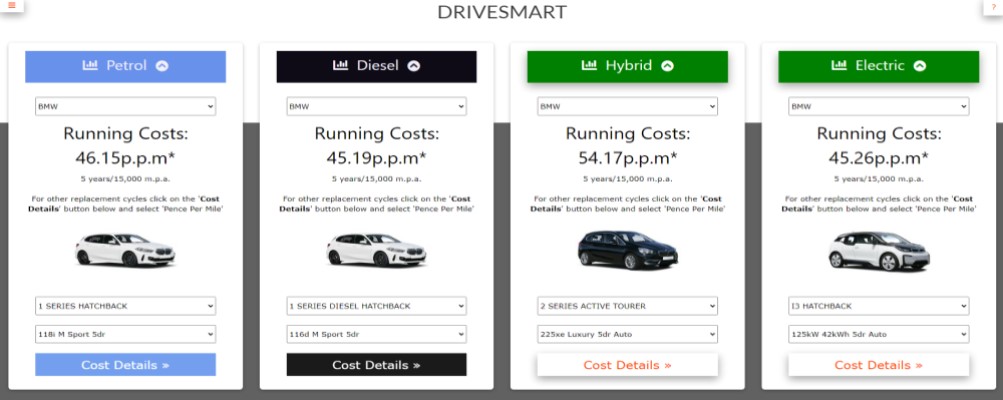

We've built an online analytical tool to compare ICE and electric car and van running costs and we have partnered with CAP-HPI to provide costs for depreciation and maintenance in the tool.

We've worked out the running costs for ICE and electric cars and vans taking account of forecasts for:

- Depreciation

- Maintenance

- Insurance

- Fuel

For depreciation, market variations between ICE and electric cars are based on CAP-HPI forecasts for second-hand values of each type of vehicle.

CAP-HPI looks at second-hand values for each type of vehicle based on equal mileages and bodywork/interior condition.

We take these second-hand value forecasts and work out depreciation based on the manufacturer's published list price, plus delivery charges and other on-the-road costs.

Don't worry about discounts - if you didn't pay the manufacturer's list price for your car/van you can tweek our calculator to use your own on-the-road price instead.

Similarly we use your own insurance premium quote, so insurance costs represent you rather than a model driver.

For ICE vehicles you can use your own local fuel costs and for electric cars and vans the kWatt charge you get from either;

- your electricity company when charging overnight; or

- your 'away' charging subscription costs.

You can also use your own fuel consumption rates (miles per gallon) or your electric vehicle's range on a full recharge.

For maintenance and servicing for both ICE and electric vehicles we use CAP-HPI forecasts based on your annual mileage.

Using Our Calculator

Setting up a cost comparison is simple;

- set your annual mileage

- pick your choice of ICE, hybrid and electric cars or vans (you don't have to choose all types - you can just look up electric vehicles)

- enter your fuel and insurance costs (we'll give you starter numbers which you can change)

Soon we'll also have a finance calculator added to the tool, so you can compare the costs of finance or leasing for an ICE or electric car.

Keep checking back to see when the upgraded tool is launched or let us know you're interested and we'll tell you when the upgrade is available.

Money, Money, Money ...

And speaking of finance, theres a whole new way of funding a car being proposed for EVs. Click here to read more about it.

Finally, there's another financial aspect to consider - tax and NIC on company cars.

We've prepared a guide to the company car tax rules for EVs, so if you're thinking of getting an electric company car then click here to read about the tax impact.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

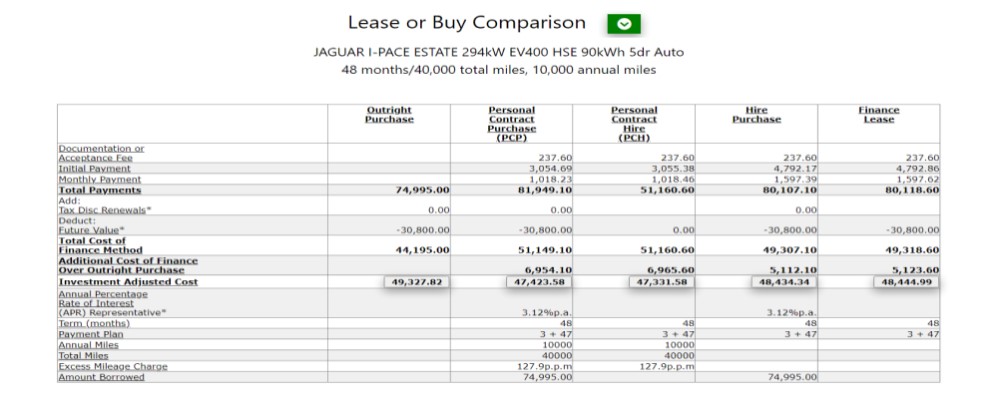

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.