The FleetPro Blog: Tax Relief For Leased Company Cars

We explain the complex rules ....

Tax Relief For Leased Company Cars

Tax Relief For Leased Company Cars

1 July 2020

Tax relief for leased company cars is based on the CO2 output an the business's accounting treatment of rentals.

Rentals Basis:

Where the cost of lease/hire rentals charged to the accounts each year is based upon the actual rentals paid then the tax relief is usually also based on the rentals paid during the accounting year.

If rental payments are abnormally loaded into an accounting year (for example, if all the rentals for the entire lease period are paid in the first accounting year, or a large deposit is paid as advance rentals) then an adjustment is required to spread the rentals over the entire hire/lease period.

Depreciation and Finance Charges Basis:

Where lease or hire rentals are split into depreciation and finance charges for accounting purposes the tax relief can be based on depreciation under the capital allowances rules, with a separate tax deduction for the finance charges implicit in the lease rentals (this is an approach used by some larger companies to follow accounting conventions for leased assets).

Tax Relief Restriction for Higher CO2 Emissions

Irrespective of the basis of tax relief, the amount allowed for tax relief purposes each year is restricted if the vehicle's CO2 emissions exceed a set threshold.

Up to April 2021 the threshold is 110g/km and the restriction is 15% of the rentals after recovered VAT.

From April 2021 the CO2 threshold will drop to 50GP/Km, though the restriction remains at 15%.

For example, if the car exceeds the CO2 threshold and total rentals in a business tax year after recovered VAT are £2000 then 15% of this (£300) is not tax deductible.

This means the tax deductible rentals for the year will be £1700 (£2000 - £300).

Where the business cannot recover VAT on the rentals (for example certain banks and insurance companies) see below.

Maintenance

If a "with maintenance" hire/lease is used the maintenance must be in a separate agreement to avoid the above restriction on tax relief applying to maintenance.

Documentation Fees

Documentation Fees are normally allowed as a 1st year cost of contract hire/leasing, subject to the 15% restriction above if the CO2 emissions exceed the threshold.

VAT on passenger car rentals

Tax relief on any unrecoverable VAT on rentals is restricted for cars with CO2 emissions exceeding the threshold using the same percentage (currently 15%) as for tax relief on the rental itself.

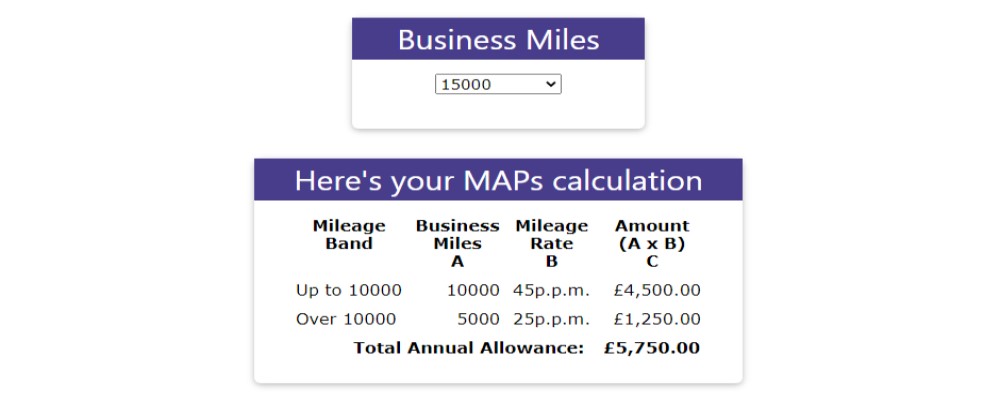

Self-employed

For the self-employed where the vehicle is used partly for non-business purposes, tax relief is apportioned according to the ratio of annual business miles to total annual miles.

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

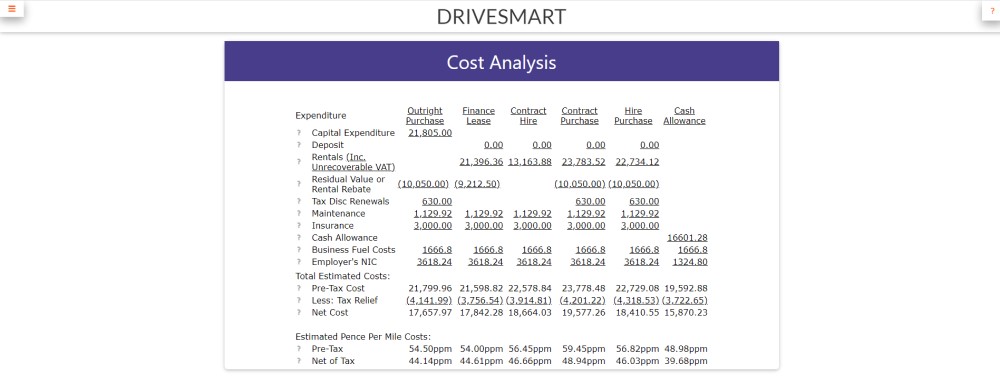

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

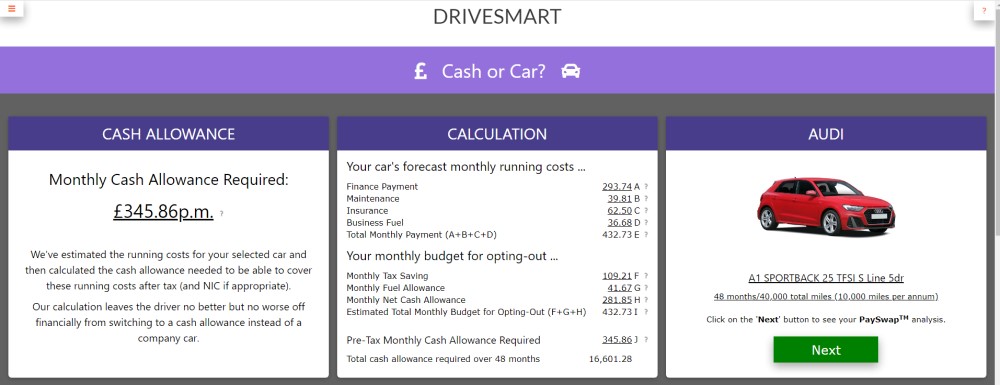

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.